Tickmill Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Regulation | ★★★★☆ | Multi-jurisdictional regulation, strong security measures |

| Account Types | ★★★★☆ | Diverse options catering to different trader needs |

| Minimum Deposit | ★★★★★ | Low $100 minimum deposit for accessibility |

| Deposit Methods | ★★★★☆ | Wide range of options, including e-wallets and local systems |

| Withdrawal Process | ★★★★☆ | Fast processing, no fees from Tickmill |

| Trading Platforms | ★★★★☆ | Industry-standard MT4, no proprietary platform |

| Spreads and Fees | ★★★★★ | Competitive spreads, including zero spread options |

| Instrument Range | ★★★☆☆ | Limited selection compared to some competitors |

| Customer Support | ★★★★☆ | Multi-channel support, extended hours, multiple languages |

| Educational Resources | ★★★★☆ | Comprehensive educational materials and market analysis |

| Mobile Trading | ★★★★☆ | Fully functional mobile app for MT4 |

| Overall User Experience | ★★★★☆ | Generally positive, with some areas for improvement |

Introduction

Tickmill has established itself as a prominent player in the online trading industry since its inception in 2014. With a monthly trading volume of over 130 million trades executed in 2018 alone across more than 200,000 registered accounts, Tickmill has become a go-to choice for many traders worldwide. This comprehensive review will delve into various aspects of Tickmill’s offerings, reputation, and key features for 2024.

Is Tickmill Real or Fake?

Legitimacy and Track Record

Tickmill is a legitimate and regulated broker with a solid track record:

- Operational since 2014, demonstrating longevity in the competitive forex industry

- Regulated by multiple reputable financial authorities

- Consistent growth in client base and trading volume over the years

Regulatory Compliance

Tickmill maintains compliance with several respected financial regulators:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Seychelles Financial Services Authority (FSA)

- Additionally registered with BaFin in Germany, CONSOB in Italy, ACPR in France, and CNMV in Spain

This multi-jurisdictional regulation enhances Tickmill’s credibility and ensures adherence to strict financial standards across different regions.

Trust and Safety Measures

Client Fund Protection

Tickmill prioritizes the safety of client funds through several measures:

- Segregation of client funds from company operational funds in Tier-1 banks

- Adherence to strict capital adequacy requirements set by regulators

- Participation in investor compensation schemes (FSCS in UK, ICF in Europe)

- Negative balance protection for all account types

Security Protocols

To safeguard client accounts and personal information, Tickmill implements:

- Strict Anti-Money Laundering (AML) procedures

- Comprehensive Know Your Customer (KYC) verification process

- Advanced data security measures including encryption and regular backups

Account Types and Minimum Deposits

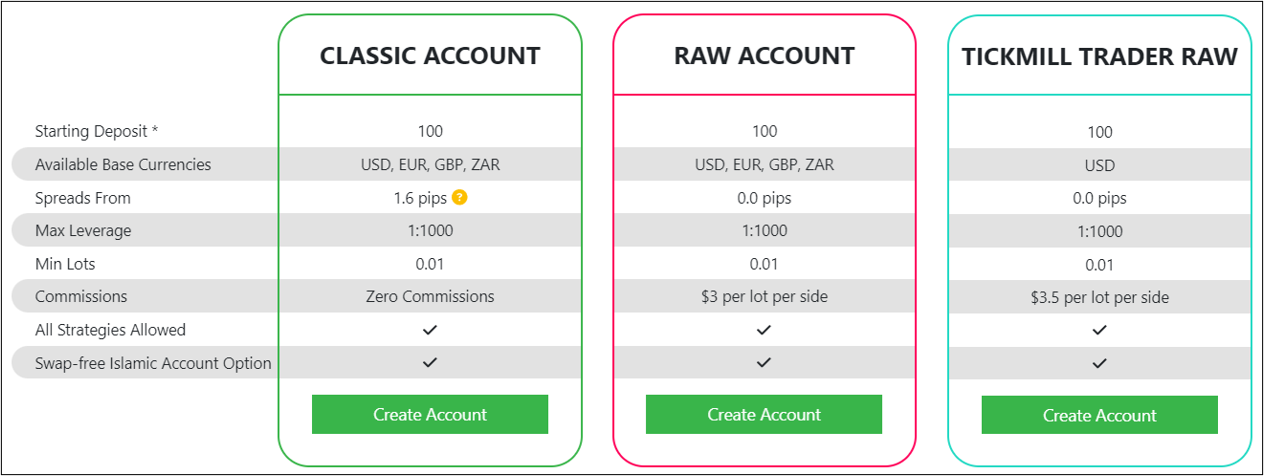

Tickmill offers three main account types to cater to different trading styles and experience levels:

- Classic Account

- Minimum deposit: $100

- Spreads from 1.6 pips

- No commission

- Suitable for beginners and intermediate traders

- Pro Account

- Minimum deposit: $100

- Spreads from 0.0 pips

- Commission: $2 per side for FX

- Ideal for more experienced traders

- VIP Account

- Minimum deposit: $50,000

- Spreads from 0.0 pips

- Commission: $1 per side for FX

- Designed for high-volume and institutional traders

All account types offer:

- Leverage up to 500:1 (subject to regulatory restrictions)

- Access to 62 FX pairs, 4 commodities, 14 indices, and 4 bonds

- Decimal pricing up to 5 decimals

- Swap-free options available (Islamic accounts)

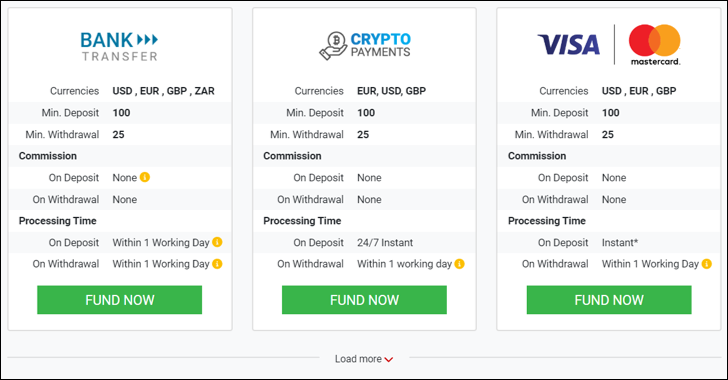

Deposits and Withdrawals

Deposit Methods

Tickmill provides a wide range of deposit options to accommodate traders globally:

- Bank transfers

- Credit/debit cards

- Electronic wallets (e.g., Skrill, Neteller)

- Local payment systems

Minimum Deposit

- General minimum deposit across account types: $100

- This relatively low entry barrier makes Tickmill accessible to new traders and those wishing to start with small capital

Withdrawal Process

Tickmill strives to make the withdrawal process as smooth as possible:

- Multiple withdrawal methods available

- No withdrawal fees charged by Tickmill (though payment providers may charge fees)

- Minimum withdrawal amount: $25

- Withdrawals typically processed quickly, often within 24 hours

Trading Conditions

Spreads

Tickmill offers competitive spreads across its account types:

- Classic Account: Variable spreads from 1.6 pips

- Pro Account: Raw spreads from 0.0 pips

- VIP Account: Raw spreads from 0.0 pips

Leverage

Tickmill provides customizable leverage options:

- Maximum leverage up to 500:1, depending on the instrument and account type

- Leverage is capped at 30:1 for retail clients in the EU and UK due to regulatory restrictions

- Professional clients may access higher leverage upon meeting certain criteria

Instruments

Tickmill offers a range of trading instruments:

- Forex: 62 currency pairs

- Commodities: 4 options

- Indices: 14 major global stock indices

- Bonds: 4 options

While the selection is not as extensive as some competitors, it covers the most popular assets for many traders.

Trading Platforms

Tickmill provides the industry-standard MetaTrader 4 (MT4) platform:

- Available on desktop, web, and mobile devices

- Supports Expert Advisors (EAs) for automated trading

- Offers extensive charting tools and technical indicators

Additional features include:

- FIX API access for advanced connectivity

- Virtual Private Server (VPS) options for improved uptime and low-latency trading

Educational Resources and Research Tools

Tickmill places a strong emphasis on trader education:

- Comprehensive learning center covering various trading topics

- Regular market updates and analysis

- Economic calendar for tracking important events

- Webinars and seminars

- Video tutorials

- Autochartist tool for technical analysis

Customer Support

Tickmill offers multi-channel customer support:

- Live chat

- Email support

- Phone support

- Available Monday through Friday from 7:00 AM until 8:00 PM GMT

- Support provided in 14 languages

Pros and Cons of Trading with Tickmill

Pros

- Low minimum deposit of $100 for most account types

- Regulated by multiple respected authorities

- Competitive spreads, including zero spread options

- Fast trade execution with no requotes

- All trading strategies welcome, including scalping and algorithmic trading

- Comprehensive educational resources and market analysis

- Multi-lingual customer support

Cons

- Limited number of tradeable assets compared to some competitors

- No proprietary trading platform offered

- US-based investors are not permitted to join

Conclusion

Tickmill stands out as a reputable broker offering a diverse range of trading options suitable for both beginners and experienced traders. Its low minimum deposit, robust regulation, and variety of account types make it an attractive choice in the competitive online trading landscape.

The broker’s commitment to security, transparent operations, and client fund protection instills confidence in its user base. The emphasis on education and market analysis, combined with competitive trading conditions and a user-friendly trading environment, makes Tickmill a solid choice for many traders.

Potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing an account type with Tickmill. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.