Doo Prime Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★☆ | Regulated by multiple authorities, but lacks top-tier licenses |

| Account Types | ★★★★☆ | Multiple account types catering to different trader needs |

| Minimum Deposit | ★★★★☆ | $100 minimum deposit for standard accounts |

| Deposit Methods | ★★★☆☆ | Limited variety of deposit methods |

| Withdrawal Process | ★★★★☆ | No withdrawal fees, but limited options |

| Trading Platforms | ★★★★★ | MT4, MT5, and proprietary In Trade platform |

| Spreads and Fees | ★★★★☆ | Competitive spreads starting from 0.1 pips |

| Instrument Range | ★★★★☆ | Over 10,000 instruments, but no cryptocurrency trading |

| Customer Support | ★★★★☆ | 24/7 support available through multiple channels |

| Educational Resources | ★★★★☆ | Decent educational materials, but room for improvement |

| Mobile Trading | ★★★★☆ | Mobile apps available for major platforms |

| Overall Experience | ★★★★☆ | Solid broker with some limitations |

Introduction

Doo Prime, established in 2014, has emerged as a notable player in the online trading industry. With a focus on providing a wide range of financial instruments and multiple account types, Doo Prime aims to cater to both novice and experienced traders. This comprehensive review will delve into various aspects of Doo Prime’s offerings, regulatory status, and key features for 2024.

Is Doo Prime Safe?

Legitimacy and Track Record

Doo Prime is a legitimate broker with a growing reputation:

- Operational since 2014, demonstrating nearly a decade of experience

- Regulated by multiple financial authorities across different jurisdictions

- Offers over 10,000 tradeable instruments across various asset classes

Regulatory Compliance

Doo Prime is regulated by several financial authorities:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

- Securities and Exchange Commission (SEC) in the US

- Vanuatu Financial Services Commission (VFSC)

- Trust or Company Service Providers (TCSP) in Hong Kong

- Financial Services Commission (FSC) in Mauritius

- Financial Services Authority (FSA) in Seychelles

While Doo Prime is regulated by multiple authorities, it’s worth noting that some of these regulators are considered less stringent than top-tier regulators like the FCA or ASIC.

Trust and Safety Measures

Client Fund Protection

Doo Prime takes several measures to protect client funds:

- Segregation of client funds from company operational funds

- Adherence to regulatory requirements set by multiple authorities

Security Protocols

To safeguard client accounts and personal information, Doo Prime implements:

- Advanced encryption technologies for data protection

- Strict verification processes for account opening and withdrawals

Account Types and Minimum Deposits

Doo Prime offers several account types to cater to different trading styles and experience levels:

- CENT Account

- Minimum deposit: $100

- Suitable for beginners and risk-averse traders

- Trading in Forex, precious metals, and commodities

- STP Account

- Minimum deposit: $100

- Standard account with average spreads

- Access to all financial assets

- ECN Account

- Minimum deposit: $5,000

- Lowest spreads for professional traders

- Access to all trading instruments

- Free VPS hosting

Additional Features:

- Demo account available for practice

- Followme account for social trading

- Myfxbook account for diversified portfolio investing

Deposits and Withdrawals

Deposit Methods

Doo Prime provides limited deposit options:

- Bank transfers

- Credit and debit cards

- Some electronic payment systems (e.g., Skrill, EPay, FasaPay, HWGC)

Minimum Deposit

- $100 for CENT and STP accounts

- $5,000 for ECN accounts

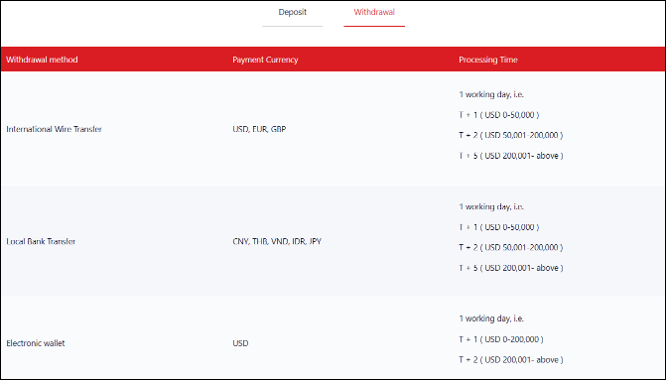

Withdrawal Process

Doo Prime processes withdrawals efficiently:

- No withdrawal fees from Doo Prime

- Processing times vary based on withdrawal amount (2-5 days)

- Limited withdrawal methods available

Trading Conditions

Spreads and Commissions

Doo Prime offers competitive pricing:

- Spreads start from 0.1 pips

- Commission-free trading on CENT and STP accounts

- ECN accounts have low spreads with commissions

Leverage

Doo Prime provides flexible leverage options:

- Up to 1:1000 leverage available (subject to regulatory restrictions)

Instruments

Doo Prime offers over 10,000 tradeable instruments:

- Forex

- CFDs on stocks

- Indices

- Commodities

- Futures

Note: Cryptocurrency trading is not available.

Trading Platforms

Doo Prime provides a variety of trading platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- In Trade (proprietary platform)

Mobile trading is supported through iOS and Android apps for the major platforms.

Educational Resources and Research Tools

Doo Prime provides some educational resources:

- Trading tutorials and guides

- Market analysis and news

- Economic calendar

While the educational content is valuable, there is room for improvement in terms of depth and variety.

Customer Support

Doo Prime offers comprehensive customer support:

- 24/7 customer service

- Support available via email, phone, and live chat

- Multilingual support team

Pros and Cons of Trading with Doo Prime

Pros

- Wide range of tradeable instruments (over 10,000)

- Multiple account types to suit different trading styles

- Regulated by several financial authorities

- Competitive spreads starting from 0.1 pips

- PAMM and MAM accounts available for passive investing

Cons

- Cryptocurrency trading not available

- Limited variety of deposit and withdrawal methods

- No first-deposit bonus for new clients

- Higher minimum deposit for ECN accounts ($5,000)

Conclusion

Doo Prime presents itself as a solid choice for traders looking for a wide range of instruments and multiple account types. Its regulatory status across several jurisdictions provides a level of trust, although it lacks top-tier licenses in some major financial hubs. The broker’s competitive spreads and diverse account offerings make it suitable for both beginners and experienced traders.

However, the lack of cryptocurrency trading options and limited deposit/withdrawal methods may be drawbacks for some traders. Additionally, while Doo Prime offers educational resources, there is room for improvement in this area to compete with top-tier brokers.

Traders should carefully consider their needs, risk tolerance, and preferred trading instruments when choosing Doo Prime as their broker. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.