BlackBull Markets Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★☆ | Regulated by FMA, lacks additional Tier-1 licenses |

| Account Types | ★★★★★ | Multiple account types catering to different trader needs |

| Minimum Deposit | ★★★★★ | $0 minimum deposit on Standard account |

| Deposit Methods | ★★★★☆ | Multiple options, including credit/debit cards and e-wallets |

| Withdrawal Process | ★★★★☆ | Quick processing, method-dependent fees may apply |

| Trading Platforms | ★★★★★ | MT4, MT5, cTrader, TradingView, and social copy trading apps |

| Spreads and Fees | ★★★★☆ | Competitive spreads, in line with industry average |

| Instrument Range | ★★★★★ | Over 26,000 tradeable symbols across multiple asset classes |

| Customer Support | ★★★★☆ | 24/7 support available, room for improvement |

| Educational Resources | ★★★★☆ | Decent resources, but limited compared to top brokers |

| Mobile Trading | ★★★★☆ | Mobile apps available for major platforms |

| Overall Experience | ★★★★☆ | Solid broker with room for improvement in some areas |

Introduction

BlackBull Markets, founded in 2014, has emerged as a notable player in the online trading industry. Based in New Zealand, the broker offers a wide range of financial instruments and multiple trading platforms. This comprehensive review will delve into various aspects of BlackBull Markets’ offerings, regulatory status, and key features for 2024.

Is BlackBull Markets Safe?

Legitimacy and Track Record

BlackBull Markets is a legitimate broker with a growing reputation:

- Operational since 2014, demonstrating nearly a decade of experience

- Regulated by the Financial Markets Authority (FMA) in New Zealand

- Offers over 26,000 tradeable symbols across various asset classes

- Recently received a significant private equity investment from Milford Private Equity Fund III LP

Regulatory Compliance

BlackBull Markets is primarily regulated by:

- Financial Markets Authority (FMA) in New Zealand

- Financial Services Authority (FSA) in Seychelles (considered a Tier-4 regulator)

While BlackBull Markets has a strong presence in New Zealand, it lacks additional Tier-1 regulatory licenses in major financial jurisdictions, which may be a concern for some traders.

Trust and Safety Measures

Client Fund Protection

BlackBull Markets takes several measures to protect client funds:

- Segregation of client funds from company operational funds

- Adherence to regulatory requirements set by the FMA

Security Protocols

To safeguard client accounts and personal information, BlackBull Markets implements:

- Advanced encryption technologies for data protection

- Strict verification processes for account opening and withdrawals

Account Types and Minimum Deposits

BlackBull Markets offers several account types to cater to different trading styles and experience levels:

- Standard Account

- No minimum deposit

- Commission-free trading with wider spreads

- Prime Account

- $2,000 minimum deposit

- Tighter spreads with $6 round-turn commission per standard lot

- Institutional Account

- $20,000 minimum deposit

- Ultra-tight spreads with $4 round-turn commission per standard lot

Additional Features:

- Demo account available for practice

- Islamic (swap-free) accounts available upon request

Deposits and Withdrawals

Deposit Methods

BlackBull Markets provides several deposit options:

- Credit/debit cards

- Bank wire transfers

- E-wallets (including Skrill and Neteller)

Minimum Deposit

- $0 for Standard account

- $2,000 for Prime account

- $20,000 for Institutional account

Withdrawal Process

BlackBull Markets processes withdrawals efficiently:

- Multiple withdrawal methods available

- Processing times may vary depending on the withdrawal method

- Some fees may apply depending on the chosen method

Trading Conditions

Spreads and Commissions

BlackBull Markets offers competitive pricing:

- Standard account: Commission-free with wider spreads

- Prime account: Tighter spreads with $6 round-turn commission per standard lot

- Institutional account: Ultra-tight spreads with $4 round-turn commission per standard lot

Leverage

BlackBull Markets provides flexible leverage options:

- Up to 1:500 leverage available (subject to regulatory restrictions)

Instruments

BlackBull Markets offers over 26,000 tradeable symbols:

- Forex

- Stocks

- Indices

- Commodities

- Cryptocurrencies

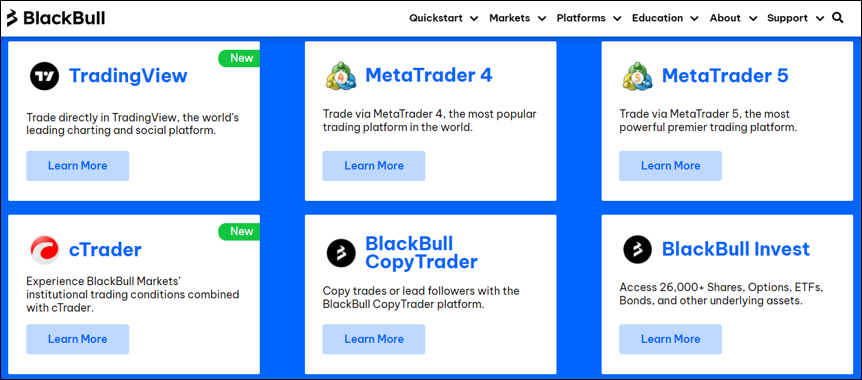

Trading Platforms

BlackBull Markets provides a variety of trading platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- TradingView

- Multiple social copy trading apps

Mobile trading is supported through iOS and Android apps for the major platforms.

Educational Resources and Research Tools

BlackBull Markets provides some educational resources:

- Trading tutorials and guides

- Market analysis and news

- Economic calendar

While the educational content is valuable, it is somewhat limited compared to top brokers in the industry.

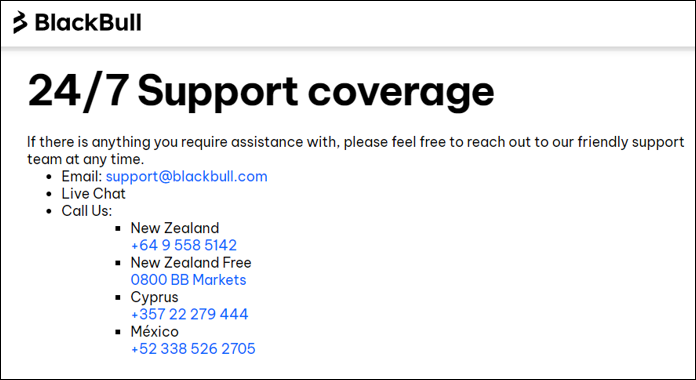

Customer Support

BlackBull Markets offers customer support:

- 24/7 customer service

- Support available via email, phone, and live chat

- Multilingual support team

Pros and Cons of Trading with BlackBull Markets

Pros

- Wide range of tradeable instruments (over 26,000 symbols)

- Multiple trading platforms, including MT4, MT5, cTrader, and TradingView

- Supports various social copy trading platforms

- Competitive spreads and commissions

- No minimum deposit for Standard account

Cons

- Lacks additional Tier-1 regulatory licenses outside of New Zealand

- Limited educational resources compared to top brokers

- Research tools could be more comprehensive

Conclusion

BlackBull Markets presents itself as a solid choice for traders, particularly those based in New Zealand. Its wide range of tradeable instruments, multiple platform options, and competitive pricing make it an attractive option for many traders. The recent private equity investment also signals potential for future growth and improvements.

However, the broker could benefit from obtaining additional Tier-1 regulatory licenses to enhance its global appeal. Expanding its educational resources and research tools would also help it compete more effectively with top-tier brokers.

Traders should carefully consider their needs, risk tolerance, and regulatory preferences when choosing BlackBull Markets as their broker. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.