IUX Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★☆ | Regulated by FSCA, strong security measures |

| Account Types | ★★★★★ | Multiple account types catering to different trader needs |

| Minimum Deposit | ★★★★★ | Low $10 minimum deposit |

| Deposit Methods | ★★★★☆ | Multiple options available, specific details not provided |

| Withdrawal Process | ★★★★☆ | Quick processing, most within 1-15 minutes |

| Trading Platforms | ★★★★☆ | MT5 and web-based platform available |

| Spreads and Fees | ★★★★☆ | Competitive spreads, zero fees on most accounts |

| Instrument Range | ★★★★☆ | Wide range of assets across multiple markets |

| Customer Support | ★★★★☆ | 24/7 support through multiple channels |

| Educational Resources | ★★★★☆ | Resources available through social media and other channels |

| Mobile Trading | ★★★★☆ | Mobile apps available for iOS and Android |

| Overall Experience | ★★★★☆ | Solid overall trading experience with some areas for improvement |

Introduction

IUX is an online broker that has been gaining attention in the financial trading industry. Regulated by the Financial Sector Conduct Authority (FSCA), IUX offers a range of trading instruments and services designed to cater to both novice and experienced traders. This comprehensive review will delve into various aspects of IUX’s offerings, regulatory status, and key features for 2024.

Is IUX Real or Fake?

Legitimacy and Track Record

IUX is a legitimate broker with a focus on providing a secure and transparent trading environment:

- Regulated by the Financial Sector Conduct Authority (FSCA)

- Offers a wide range of trading instruments including currencies, commodities, cryptocurrencies, indices, and stocks

- Known for cutting-edge trading technology and exceptional customer support

Regulatory Compliance

IUX is primarily regulated by:

- Financial Sector Conduct Authority (FSCA) of South Africa

- Financial Services Commission (FSC)

The broker is also in the process of obtaining licenses from:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) of Seychelles

While IUX’s regulatory coverage is not as extensive as some larger brokers, it demonstrates a commitment to compliance and is actively expanding its regulatory framework.

Trust and Safety Measures

Client Fund Protection

IUX prioritizes the safety of client funds through several measures:

- Implementation of rigorous AML (Anti-Money Laundering) and KYC (Know Your Customer) policies

- Advanced fraud detection tools

- Management of funds through intermediate financial institutions

Security Protocols

To safeguard client accounts and personal information, IUX implements:

- Verification of client identity through official documents

- Monitoring of client activity and detailed record-keeping

- Reporting of suspicious transactions

Account Types and Minimum Deposits

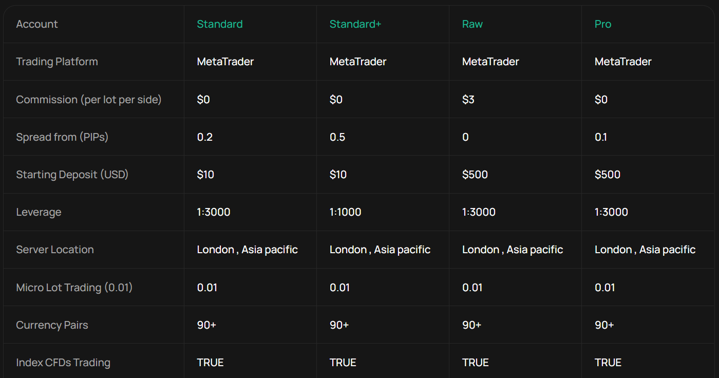

IUX offers several account types to cater to different trading styles and experience levels:

- Standard Account

- Most popular account type

- Suitable for traders of all levels

- Standard+ Account

- Offers deposit bonus of up to 35%

- No trading commission

- Raw Account

- Tight spreads from 0.0 pips

- Fixed commission of $3 per lot per side

- Pro Account

- Designed for professional traders

- Commission-free trading

Additional Features:

- Demo account available for practice

- Islamic accounts available (swap-free)

Minimum Deposit:

- $10 for all account types

IUX does not offer services to US traders.

Deposits and Withdrawals

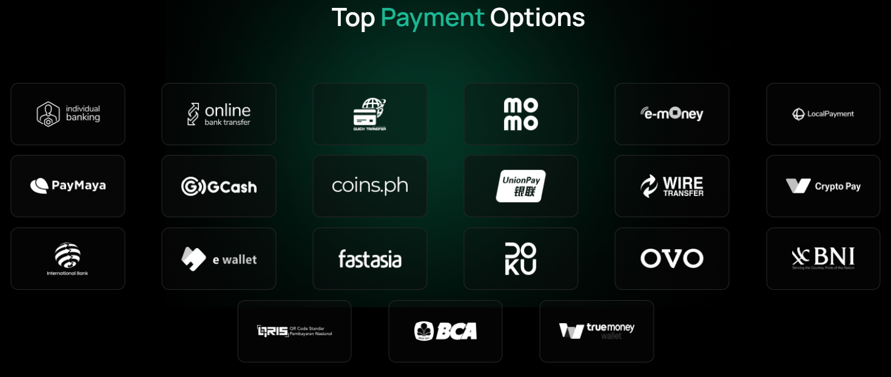

Deposit Methods

IUX provides several deposit options, though specific methods are not detailed in the given information.

Minimum Deposit

- $10 for all account types

Withdrawal Process

IUX strives to make the withdrawal process efficient:

- Multiple withdrawal methods available

- Most withdrawals processed within 1-15 minutes

- Some methods may take 24 hours to 3-5 days

Trading Conditions

Spreads and Commissions

IUX offers competitive pricing:

- Standard and Standard+ accounts: No commission

- Raw account: Fixed commission of $3 per lot per side

- Pro account: Commission-free trading

Leverage

Specific leverage ratios are not provided in the given information.

Instruments

IUX offers a wide range of trading instruments:

- Currencies: Major pairs like EURUSD, GBPUSD, USDJPY, and exotic pairs

- Commodities: Metals (gold, silver) and energy products (crude oil)

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and others

- Indices: S&P 500, US30, DE30, HK50, and more

- Stocks: Shares from global companies like Apple, Amazon, Google, JPMorgan, and others

Trading Platforms

IUX provides the following trading platforms:

MetaTrader 5 (MT5)

- Advanced trading platform with extensive features

- Available for desktop and mobile devices

Web-based Platform

- Trading directly through web browsers

- No download required

Mobile Trading

- Mobile apps available for iOS and Android devices

- Full functionality for on-the-go trading

Educational Resources and Research Tools

IUX provides educational resources through various channels:

- YouTube channel

- LinkedIn, Facebook, and Instagram profiles

- Webinars

- Articles

- Academy section

- Glossary

While the educational offerings are somewhat limited compared to some competitors, IUX focuses on providing practical, real-time information to help traders improve their skills and market understanding.

Customer Support

IUX offers comprehensive customer support:

- 24/7 availability

- Support via live chat, email, and bot service

- Multilingual support team

Pros and Cons of Trading with IUX

Pros

- Cutting-edge trading technology

- Exceptional customer support

- Comprehensive financial services

- Transparent and secure platform

- Innovative trading tools

- Low minimum deposit of $10

Cons

- Limited educational resources

- Requires proof of identity

- Specific verification documents needed

- Only regulated by FSCA (additional licenses pending)

- Limited advanced analytical tools

Conclusion

IUX presents itself as a modern and accessible broker, offering a range of features that cater to both novice and experienced traders. Its low minimum deposit, competitive spreads, and diverse instrument range make it an attractive option for many traders. The broker’s commitment to security and customer support is commendable, although its regulatory coverage is currently limited compared to some larger brokers.

While IUX excels in areas like trading technology and customer service, it could improve its educational resources and expand its regulatory framework to enhance its overall offering. Traders considering IUX should weigh its strengths in technology and accessibility against its limitations in educational resources and regulatory coverage.

As with any financial decision, potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing IUX. It’s advisable to start with a demo account to familiarize oneself with the platform before committing real funds.