FP Markets Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★★ | Multi-jurisdictional regulation, strong security measures |

| Account Types | ★★★★★ | Various account types catering to different trader needs |

| Minimum Deposit | ★★★★☆ | $100 minimum deposit, higher than some competitors |

| Deposit Methods | ★★★★★ | Multiple options, no fees from FP Markets |

| Withdrawal Process | ★★★★★ | No fees, multiple methods available |

| Trading Platforms | ★★★★★ | MT4, MT5, cTrader, and TradingView available |

| Spreads and Fees | ★★★★☆ | Competitive spreads from 0.0 pips, some commissions on certain accounts |

| Instrument Range | ★★★★★ | Wide range of assets across multiple markets |

| Customer Support | ★★★★★ | 24/7 multilingual support through multiple channels |

| Educational Resources | ★★★★☆ | Comprehensive resources, room for improvement in advanced topics |

| Mobile Trading | ★★★★★ | Fully functional mobile apps for iOS and Android |

| Overall Experience | ★★★★★ | Excellent overall trading experience with minor areas for improvement |

Introduction

FP Markets, also known as First Prudential Markets, is an Australia-based broker that has established itself as a versatile player in the online trading industry. Founded in 2005, FP Markets has built a reputation for offering a wide range of financial instruments, competitive trading conditions, and a secure trading environment. This comprehensive review will delve into various aspects of FP Markets’ offerings, regulatory status, and key features for 2024.

Is FP Markets Real or Fake?

Legitimacy and Track Record

FP Markets is a legitimate and well-established broker with a solid track record:

- Operational since 2005, demonstrating nearly two decades of experience in the industry

- Serves a global client base with a focus on providing comprehensive trading services

- Recipient of over 50 global industry awards

- Known for tight raw spreads and diverse trading instruments

Regulatory Compliance

FP Markets maintains compliance with several respected financial regulators:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) of St. Vincent and the Grenadines

- Financial Sector Conduct Authority (FSCA) of South Africa

- Compliant with MiFID II regulations

This multi-jurisdictional regulation enhances FP Markets’ credibility and ensures adherence to strict financial standards across different regions.

Trust and Safety Measures

Client Fund Protection

FP Markets prioritizes the safety of client funds through several measures:

- Segregation of client funds in top-tier banks

- Adherence to strict capital adequacy requirements set by regulators

Security Protocols

To safeguard client accounts and personal information, FP Markets implements:

- Advanced encryption protocols for secure transactions

- Continuous monitoring of suspicious activities

- Secure payment gateways

Account Types and Minimum Deposits

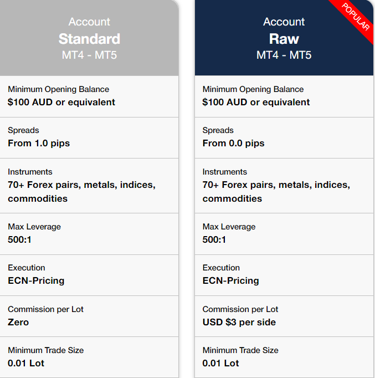

FP Markets offers several account types to cater to different trading styles and experience levels:

- Standard Account

- Suitable for most traders

- Commission-free trading

- Competitive spreads

- Raw Account

- Designed for high-volume traders

- Tighter spreads with commission

- Islamic Account

- Swap-free account in compliance with Sharia law

- Demo Account

- Practice account with virtual funds

Additional Features:

- Managed accounts available for those seeking professional management

- Segregated accounts provided for enhanced fund security

Minimum Deposit:

- $100 for all account types

FP Markets does not offer services to US traders due to regulatory constraints.

Deposits and Withdrawals

Deposit Methods

FP Markets provides several deposit options:

- Credit/debit cards

- Bank wire transfers

- E-wallets (specific options not detailed in the given information)

Minimum Deposit

- $100 for all account types

Withdrawal Process

FP Markets strives to make the withdrawal process smooth:

- Multiple withdrawal methods available

- No withdrawal fees charged by FP Markets

- Processing times typically within 1-3 working days

Trading Conditions

Spreads and Commissions

FP Markets offers competitive pricing:

- Raw spreads from 0.0 pips on Raw accounts

- Commission charges on Raw accounts

- Competitive spreads on Standard accounts with no commission

Leverage

FP Markets provides flexible leverage options:

- Specific leverage ratios not provided in the given information

- May vary depending on the instrument and regulatory requirements

Instruments

FP Markets offers a wide range of trading instruments:

- Forex: Over 70 currency pairs

- Commodities: Over 70 options including precious metals and energy resources

- Cryptocurrencies: Popular digital assets like Bitcoin, Ethereum, Ripple

- Indices: Global stock market indices

- Stocks: Wide range of global stocks

- ETFs: Exchange-traded funds

- Bonds: Fixed-income securities

- Options: Sophisticated trading strategies

- Futures: Contracts for future delivery

Trading Platforms

FP Markets provides a variety of trading platforms:

MetaTrader 4 (MT4)

- Classic platform with extensive charting tools

- Supports Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Advanced version of MT4 with additional features

- More timeframes and analytical tools

- Enhanced backtesting capabilities

cTrader

- Modern platform with advanced charting and order management

- Supports algorithmic trading and custom indicators

- Available on desktop, web, and mobile

TradingView

- Popular charting platform with social trading features

- Integrated with FP Markets for seamless trading

Mobile Trading

- Dedicated mobile apps for MT4, MT5, and cTrader

- Available for iOS and Android devices

- Offers full trading functionality on-the-go

Educational Resources and Research Tools

FP Markets provides a range of educational resources:

- Comprehensive Learning Center with articles, videos, and tutorials

- Webinars on various trading topics

- Market analysis and insights

- Demo account for practice trading

While the educational content is extensive, there’s room for improvement in advanced topics and more interactive learning experiences.

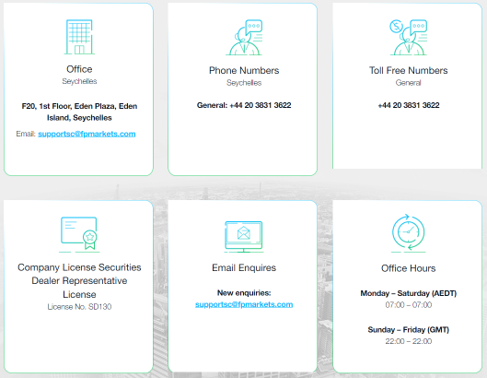

Customer Support

FP Markets offers comprehensive customer support:

- 24/7 multilingual customer support

- Assistance via live chat, email, and phone

- Support available during standard and extended hours

Pros and Cons of Trading with FP Markets

Pros

- Tight raw spreads from 0.0 pips

- Multiple trading platforms including MT4, MT5, cTrader, and TradingView

- 24/7 multilingual customer support

- Over 50 global industry awards

- Social trading capabilities

- Industry-leading partnerships

Cons

- $100 minimum deposit, higher than some competitors

- Limited educational resources for advanced traders

- Few advanced analytical tools compared to some specialized platforms

Conclusion

FP Markets stands out as a reputable broker offering a wide range of trading options suitable for both novice and experienced traders. Its competitive spreads, diverse instrument range, and multiple trading platforms make it an attractive choice in the online trading landscape.

The broker’s commitment to regulatory compliance, client fund security, and efficient customer support instills confidence in its user base. While there are some limitations, such as the higher minimum deposit and room for improvement in advanced educational resources, FP Markets compensates with its comprehensive offerings, competitive pricing, and robust trading environment.

Potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing FP Markets. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.