JustMarkets Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★☆ | Multi-jurisdictional regulation, strong security measures |

| Account Types | ★★★★★ | Four account types catering to different trader needs |

| Minimum Deposit | ★★★★★ | Low $10 minimum deposit |

| Deposit Methods | ★★★★★ | Multiple options, no fees from JustMarkets |

| Withdrawal Process | ★★★★☆ | No fees, multiple methods, processing time up to 4 hours |

| Trading Platforms | ★★★★☆ | MT4, MT5, and proprietary mobile app available |

| Spreads and Fees | ★★★★☆ | Competitive spreads from 0 points, some fixed commissions |

| Instrument Range | ★★★★☆ | Wide range of assets, but no futures or ETFs |

| Customer Support | ★★★★★ | 24/7 multilingual support through multiple channels |

| Educational Resources | ★★★★☆ | Comprehensive resources, including market analysis and strategies |

| Mobile Trading | ★★★★★ | Fully functional mobile apps for iOS and Android |

| Overall Experience | ★★★★☆ | Solid overall trading experience with some areas for improvement |

Introduction

JustMarkets is a versatile online broker offering a wide range of trading instruments to traders worldwide. With a focus on providing competitive trading conditions and a secure trading environment, JustMarkets has gained recognition for its tight spreads, diverse asset offerings, and innovative features. This comprehensive review will delve into various aspects of JustMarkets’ services, regulatory status, and key features for 2024.

Is JustMarkets Real or Fake?

Legitimacy and Track Record

JustMarkets is a legitimate and established broker with a solid regulatory foundation:

- Offers a wide range of trading instruments including currencies, CFDs on commodities, indices, shares, and cryptocurrencies

- Known for tight spreads and flexible leverage options

- Provides innovative features such as copytrading and swap-free trading

Regulatory Compliance

JustMarkets maintains compliance with several respected financial regulators:

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA)

- Financial Sector Conduct Authority (FSCA)

- Financial Services Commission (FSC)

This multi-jurisdictional regulation enhances JustMarkets’ credibility and ensures adherence to strict financial standards across different regions.

Trust and Safety Measures

Client Fund Protection

JustMarkets prioritizes the safety of client funds through several measures:

- Segregation of client funds in separate bank accounts

- Deposits made with reputable and well-capitalized banks

- Protection from negative balances

Security Protocols

To safeguard client accounts and personal information, JustMarkets implements:

- SSL data transfer protection

- Multilevel server system for uninterrupted service

- Data encryption for both transfer and storage

- Semi-automated customer and transaction monitoring

- Rigorous identification and risk categorization processes

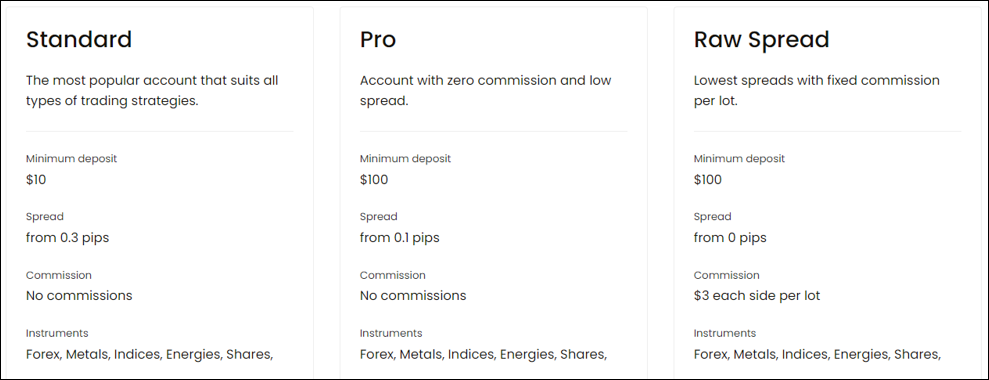

Account Types and Minimum Deposits

JustMarkets offers four main account types to cater to different trading styles and experience levels:

- Standard Cent Account

- Ideal for beginners

- Micro lot sizes of 1,000 units

- Minimum deposit: $10

- Spreads from 0.3 pips

- Available on MT4 only

- Standard Account

- Suitable for more experienced traders

- Standard lot sizes of 100,000 units

- Minimum deposit: $10

- Spreads from 0.3 pips

- Available on MT4 and MT5

- Pro Account

- Designed for professional traders

- Standard lot sizes of 100,000 units

- Minimum deposit: $100

- Spreads from 0.1 pips

- Available on MT4 and MT5

- Raw Spread Account

- For traders preferring fixed commissions

- Standard lot sizes of 100,000 units

- Minimum deposit: $100

- Spreads from 0 pips with fixed commissions

- Available on MT4 and MT5

Additional Features:

- Demo account available for practice

- Islamic (swap-free) accounts available to all traders

- Segregated accounts provided for enhanced fund security

JustMarkets does not offer services to US traders.

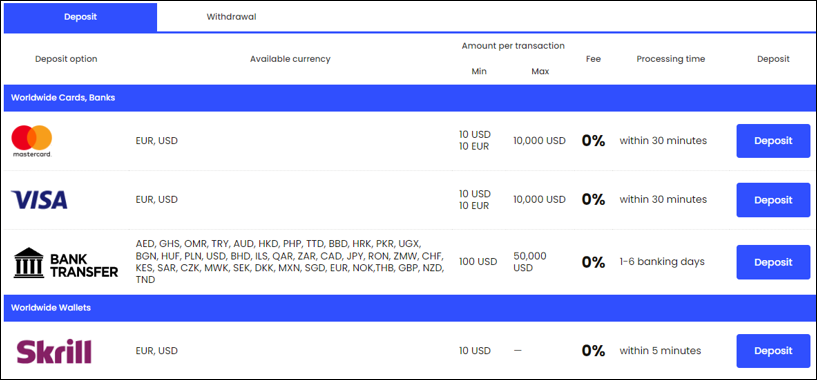

Deposits and Withdrawals

Deposit Methods

JustMarkets provides several deposit options:

- Bank transfers

- Credit/debit cards

- E-wallets

- Local agents

- Cryptocurrencies

Minimum Deposit

- $10 for Standard Cent and Standard accounts

- $100 for Pro and Raw Spread accounts

Withdrawal Process

JustMarkets strives to make the withdrawal process smooth:

- Multiple withdrawal methods available

- No withdrawal fees charged by JustMarkets

- Processing times typically range from 30 minutes to 4 hours

Trading Conditions

Spreads and Commissions

JustMarkets offers competitive pricing:

- Spreads from 0 points on Raw Spread accounts

- Fixed commissions on Raw Spread accounts (e.g., $3 per lot/side for Forex)

- Competitive spreads on other account types

Leverage

JustMarkets provides flexible leverage options:

- Specific leverage ratios not provided in the given information

- Described as “flexible leverage range”

Instruments

JustMarkets offers a wide range of trading instruments:

- Forex: Major, minor, and exotic pairs

- CFDs on commodities: US Natural Gas, Gold, Silver, Crude Oil, etc.

- CFDs on indices: AU200, DE40, US100, US500, etc.

- CFDs on shares: Wide range of US and EU shares

- CFDs on cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple, etc.

It’s worth noting that JustMarkets does not offer futures trading or ETFs.

Trading Platforms

JustMarkets provides a variety of trading platforms:

MetaTrader 4 (MT4)

- Classic platform with extensive charting tools

- Supports Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Advanced version of MT4 with additional features

- More timeframes and analytical tools

- Enhanced backtesting capabilities

JM Mobile Trading App

- Proprietary mobile trading app

- Available for iOS and Android devices

Web Trading

- MT4 and MT5 WebTrader platforms available

- Access from any web browser without downloads

Educational Resources and Research Tools

JustMarkets provides a range of educational resources:

- Detailed market analyses

- Trading strategies

- Educational articles covering various trading topics

- Resources suitable for both beginners and experienced traders

Customer Support

JustMarkets offers comprehensive customer support:

- 24/7 customer service

- Multilanguage support (English, Indonesian, Malaysian, Spanish, Portuguese)

- Assistance via live chat, email, messengers, and phone calls

- Detailed Help Center and chatbot for self-learning and troubleshooting

Pros and Cons of Trading with JustMarkets

Pros

- Tight spreads starting from 0 points

- Swap-free trading available to all traders

- Wide variety of trading instruments

- Flexible leverage range

- Innovative copytrading system

- Low minimum deposit of $10 for some account types

Cons

- No futures trading available

- Fixed commission on Raw Spread accounts

- Inactivity fee of $5 after 150 days of no activity

- Processing time for withdrawals (up to 4 hours)

Conclusion

JustMarkets stands out as a versatile broker offering a wide range of trading options suitable for both novice and experienced traders. Its low minimum deposit, competitive spreads, and innovative features like copytrading make it an attractive choice in the online trading landscape.

The broker’s commitment to security, regulatory compliance, and efficient customer support instills confidence in its user base. While there are some limitations, such as the absence of futures trading and inactivity fees, JustMarkets compensates with its diverse instrument range, flexible account types, and user-friendly platforms.

Potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing JustMarkets. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.