Vantage Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★☆ | Regulated by CIMA, client funds segregation |

| Account Types | ★★★★★ | Four account types catering to different trader needs |

| Minimum Deposit | ★★★★★ | Low $50 minimum deposit |

| Deposit Methods | ★★★★★ | Multiple options, no fees from Vantage |

| Withdrawal Process | ★★★★☆ | Multiple methods, processing times may vary |

| Trading Platforms | ★★★★★ | MT4, MT5, proprietary platforms, and social trading options |

| Spreads and Fees | ★★★★☆ | Competitive spreads, commission-free options available |

| Instrument Range | ★★★★★ | Over 300 tradable instruments across multiple markets |

| Customer Support | ★★★★☆ | 24/7 support through multiple channels |

| Educational Resources | ★★★★☆ | Comprehensive resources, including PRO Trader Tools |

| Mobile Trading | ★★★★★ | Intuitive mobile app with extensive functionality |

| Overall Experience | ★★★★★ | Excellent overall trading experience with minor areas for improvement |

Introduction

Vantage, established in 2009, has emerged as a significant player in the online trading industry. Owned and operated by Vantage International Group Limited, the broker offers a wide range of financial instruments and serves over 3,000,000 users globally. This comprehensive review will delve into various aspects of Vantage’s offerings, regulatory status, and key features for 2024.

Is Vantage Real or Fake?

Legitimacy and Track Record

Vantage is a legitimate and well-established broker with a solid track record:

- Operational since 2009, demonstrating over a decade of experience in the industry

- Serves more than 3,000,000 users globally

- Offers over 300 tradable instruments across various asset classes

- Recipient of numerous industry awards, including:

- Best in class – social copy trading 2024

- Global Brands Magazine – Best CFD Broker 2024

- DayTrading – Top Overall Broker for Australia 2024

- Most Trusted Broker, by Professional Trader Awards 2023

Regulatory Compliance

Vantage is regulated by several financial authorities:

- Cayman Islands Monetary Authority (CIMA)

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA) of South Africa

- SVGFSA

- Vanuatu Financial Services Commission (VFSC)

This multi-jurisdictional regulation enhances Vantage’s credibility and ensures adherence to strict financial standards across different regions.

Trust and Safety Measures

Client Fund Protection

Vantage prioritizes the safety of client funds through several measures:

- Segregation of client funds from company operational funds

- Compliance with the Securities Investment Business Law (SIBL)

- Indemnity insurance covering the work of representatives, employees, and authorized individuals

Security Protocols

To safeguard client accounts and personal information, Vantage implements:

- Advanced security measures (specific details not provided in the given information)

- Strict authentication procedures to prevent unauthorized access

Account Types and Minimum Deposits

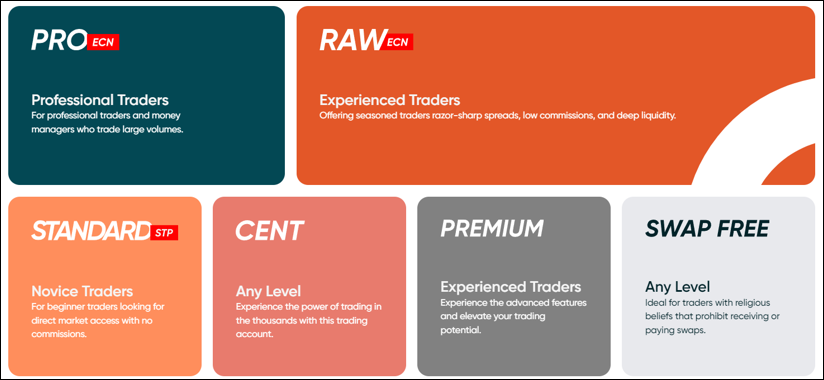

Vantage offers four main account types to cater to different trading styles and experience levels:

- RAW ECN Account

- Minimum deposit: $500

- Spreads from 0.0 pips

- Commission: $3 per trade

- Standard STP Account

- Minimum deposit: $300

- Spreads from 1.4 pips

- No commission

- PRO ECN Account

- Minimum deposit: $20,000

- Spreads from 0.0 pips

- Commission: $2 per trade

- Swap-Free Trading Account

- Minimum deposit: $200

- Spreads from 1.4 pips

- No commission (small administration fee per trade)

Additional Features:

- Demo account available for practice

- Copy trading support on all account types

- Maximum leverage up to 500:1 (depending on regulatory restrictions)

Vantage does not offer services to US or Canadian traders due to regulatory constraints.

Deposits and Withdrawals

Deposit Methods

Vantage provides several deposit options:

- Credit/debit cards

- Bank wire transfers

- E-wallets (PayPal, Skrill, Neteller)

- Union Pay

- SticPay

- BitWallet

Minimum Deposit

- General minimum deposit: $50 (may vary by account type)

Withdrawal Process

Vantage strives to make the withdrawal process smooth:

- Multiple withdrawal methods available

- No withdrawal fees mentioned in the given information

- Processing times may vary depending on the method used

Trading Conditions

Spreads and Commissions

Vantage offers competitive pricing:

- RAW ECN Account: Spreads from 0.0 pips, $3 commission per trade

- Standard STP Account: Spreads from 1.4 pips, no commission

- PRO ECN Account: Spreads from 0.0 pips, $2 commission per trade

- Swap-Free Trading Account: Spreads from 1.4 pips, small administration fee per trade

Leverage

Vantage provides high leverage options:

- Maximum leverage up to 500:1 (subject to regulatory restrictions)

Instruments

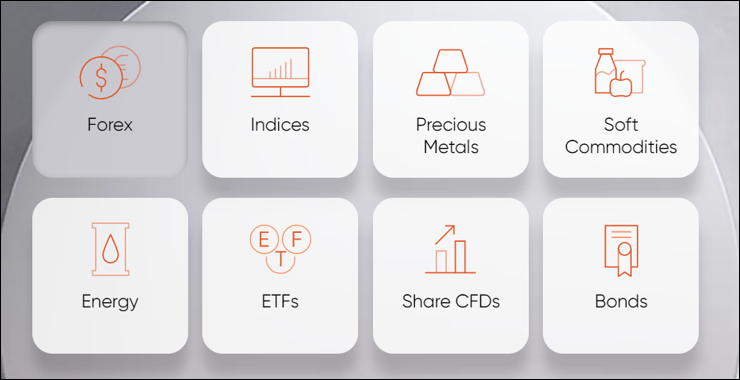

Vantage offers over 300 tradable instruments:

- Forex pairs

- Indices

- Energies

- Soft commodities

- Precious metals

- Share CFDs

- Cryptocurrency CFDs

Educational Resources and Research Tools

Vantage provides a range of educational resources and research tools:

- PRO Trader Tools (for accounts with over $1,000 deposit)

- Access to information on over 35,000 tradable assets

- Premium economic calendar

- Market Buzz AI-based market news coverage

- Featured ideas and analyst views

- Advanced video tutorials

- SmartTrader tools

- Manuals and tutorials for all platforms

- Courses on investing fundamentals

Trading Platforms

Vantage provides a variety of trading platforms:

MetaTrader 4 (MT4)

- Classic platform with extensive charting tools

- Supports Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Advanced version of MT4 with additional features

- More timeframes and analytical tools

- Enhanced backtesting capabilities

Proprietary Web-based Platform

- Vantage’s own web-based trading platform

Proprietary Mobile Trading App

- Intuitive mobile app with extensive functionality

- Available for iOS and Android devices

Social Trading Platforms

- ZuluTrade

- MyFXBook

- DupliTrade

Customer Support

Vantage offers comprehensive customer support:

- 24/7 customer service during trading hours

- Support available via email, chat, and phone

- Multi-lingual support team

- Dispute resolution services available through the website

Pros and Cons of Trading with Vantage

Pros

- Excellent value-added trading tools and services

- Very competitive narrow spreads and low commissions

- Intuitive mobile app with extensive functionality

- Strong range of asset classes available

- Extensive incentives and rebates

- Copy trading available

Cons

- Not available to US-based investors

- Lesser offering compared to some other brokers

- High leverage can expose traders to significant risk

Conclusion

Vantage stands out as a reputable broker offering a wide range of trading options suitable for both novice and experienced traders. Its low minimum deposit, competitive spreads, and diverse range of trading platforms make it an attractive choice in the online trading landscape.

The broker’s commitment to providing value-added services, fast trade execution, and excellent support is evident in its numerous industry accolades. While there are some limitations, such as the unavailability to US-based traders, Vantage compensates with its comprehensive educational resources, advanced trading tools, and user-friendly trading environment.

Potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing Vantage. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.