FxPro Rating Table

| Factor | Rating | Comments |

|---|---|---|

| Trust and Safety | ★★★★★ | Multi-jurisdictional regulation, strong security measures |

| Account Types | ★★★★☆ | 4 account types available, catering to various trader needs |

| Minimum Deposit | ★★★☆☆ | $100 minimum deposit, higher than some competitors |

| Deposit Methods | ★★★★☆ | Wide range of options, including e-wallets |

| Withdrawal Process | ★★★★☆ | No fees from FxPro, multiple withdrawal methods available |

| Trading Platforms | ★★★★★ | MT4, MT5, cTrader, and proprietary platforms available |

| Spreads and Fees | ★★★★★ | Competitive spreads and transparent fee structure |

| Instrument Range | ★★★★★ | 2,100+ tradable assets across multiple markets |

| Customer Support | ★★★★★ | 24/5 customer support available through multiple channels |

| Educational Resources | ★★★★☆ | Comprehensive resources, but room for improvement |

| Mobile Trading | ★★★★★ | Fully functional mobile apps for iOS and Android |

| Overall Experience | ★★★★★ | Excellent overall trading experience with some minor areas for improvement |

Introduction

FxPro, established in 2006, has emerged as a global leader in the forex and CFD brokerage industry. With over 2 million clients across 170+ countries and more than 635 million executed orders, FxPro has built a strong reputation for reliability and innovation. This comprehensive review will delve into various aspects of FxPro’s offerings, regulatory status, and key features for 2024.

Is FxPro Real or Fake?

Legitimacy and Track Record

FxPro is a legitimate and well-established broker with a solid track record:

- Operational since 2006, demonstrating nearly two decades of experience in the industry

- Serves over 2 million clients from 170+ countries

- Has executed more than 635 million orders

- Prestigious sponsorship with the McLaren F1 team, indicating financial stability and brand recognition

Regulatory Compliance

FxPro maintains compliance with several respected financial regulators:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA) in South Africa

- Compliant with MiFID II regulations

This multi-jurisdictional regulation enhances FxPro’s credibility and ensures adherence to strict financial standards across different regions.

Trust and Safety Measures

Client Fund Protection

FxPro prioritizes the safety of client funds through several measures:

- Segregation of client funds from company operational funds

- Adherence to strict capital adequacy requirements set by regulators

Security Protocols

To safeguard client accounts and personal information, FxPro implements:

- Advanced encryption technology for secure transactions

- Rigorous identity verification processes to prevent unauthorized access

Account Types and Minimum Deposits

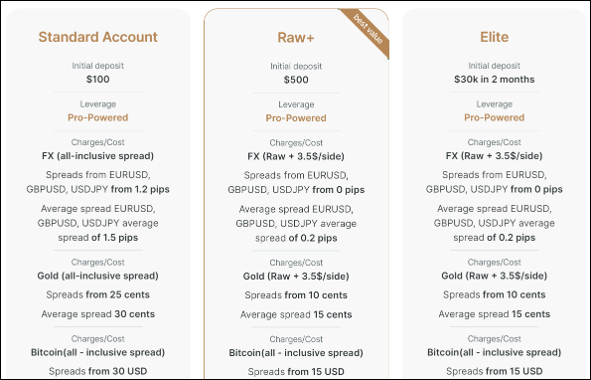

FxPro offers four main account types to cater to different trading styles and experience levels:

- FxPro MT4 Account

- Popular among traders familiar with MetaTrader 4

- Minimum deposit: $100

- FxPro MT5 Account

- Offers advanced features of MetaTrader 5

- Minimum deposit: $100

- FxPro cTrader Account

- Provides access to the cTrader platform

- Minimum deposit: $100

- FxPro Edge Account

- Proprietary platform with unique features

- Minimum deposit: $100

Additional account options:

- Demo Account: Practice account with virtual funds

- Islamic Account: Swap-free account in compliance with Sharia law

FxPro does not offer managed accounts, and its services are not available to US traders due to regulatory constraints.

Deposits and Withdrawals

Deposit Methods

FxPro provides a wide range of deposit options to accommodate traders globally:

- Credit/Debit cards

- Bank Wire

- E-wallets (e.g., Skrill, Neteller)

Minimum Deposit

- General minimum deposit across account types: $100

- This entry barrier is higher than some competitors but still accessible to many traders

Withdrawal Process

FxPro strives to make the withdrawal process as smooth as possible:

- Multiple withdrawal methods available

- No withdrawal fees charged by FxPro

- Withdrawal processing times vary depending on the chosen method

Trading Conditions

Spreads

FxPro offers competitive spreads:

- Spreads vary depending on the account type and instrument traded

- Raw spreads available on certain account types

Leverage

FxPro provides customizable leverage options:

- Maximum leverage varies depending on the instrument and regulatory requirements

- Ranges from 1:30 to 1:500, subject to regulatory restrictions

Instruments

FxPro offers over 2,100 tradable assets across various markets:

- Forex: 70+ currency pairs

- Cryptocurrencies: CFDs on major cryptocurrencies

- Commodities: CFDs on metals, energies, and agricultural products

- Indices: CFDs on major global indices

- Stocks: CFDs on shares from various global exchanges

- Futures: CFDs on futures contracts

Trading Platforms

FxPro provides a variety of trading platforms to suit different preferences:

MetaTrader 4 (MT4)

- Classic platform with extensive charting tools

- Supports Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Advanced version of MT4 with additional features

- More timeframes and analytical tools

- Enhanced backtesting capabilities

cTrader

- Modern platform with advanced charting and order management

- Supports algorithmic trading and custom indicators

- Available on desktop, web, and mobile

FxPro Edge

- Proprietary platform with unique features

- User-friendly interface designed for optimal trading experience

Mobile Trading

- Dedicated mobile apps for MT4, MT5, cTrader, and FxPro Edge

- Available for iOS and Android devices

- Allows trading on-the-go with full account functionality

Educational Resources and Research Tools

FxPro provides a range of educational resources, although there’s room for improvement:

Learning Center

- Articles and guides on trading strategies and market analysis

- Video tutorials covering various trading topics

- Webinars and seminars on market insights and trading techniques

Market Analysis

- Regular market updates and analysis

- Economic calendar for tracking important events

Demo Account

- Available for practice and strategy testing

- Mirrors live trading conditions

Customer Support

FxPro offers comprehensive customer support:

- 24/5 customer service

- Multiple languages supported

- Support available via live chat, email, and phone

Pros and Cons of Trading with FxPro

Pros

- Regulated by reputable authorities

- Wide range of trading instruments (2,100+ assets)

- Multiple trading platforms available

- Competitive spreads and transparent fee structure

- 24/5 customer support

- Advanced trading tools and features

Cons

- $100 minimum deposit, higher than some competitors

- Limited educational resources compared to some industry leaders

- Not available to US traders

Conclusion

FxPro stands out as a reputable broker offering a diverse range of trading options suitable for both beginners and experienced traders. Its multi-regulatory status, extensive selection of tradable assets, and variety of trading platforms make it an attractive choice in the online trading landscape.

The broker’s commitment to transparency, competitive pricing, and client support instills confidence in its user base. While there’s room for improvement in educational resources, FxPro compensates with advanced trading tools, a user-friendly interface, and excellent customer support.

Potential traders should carefully consider their trading goals, risk tolerance, and experience level when choosing FxPro. As always, it’s crucial to conduct thorough research and possibly start with a demo account before committing to live trading.